Connect with us for all your queries

Meet Rohan and Priya. They were college sweethearts who built a life together over 12 years of marriage. Rohan, a corporate executive, was the primary earner, while Priya had left her job to raise their two kids.

But as life took its course, their marriage fell apart. When they divorced, Rohan agreed to pay Priya ₹50 lakh as a one-time alimony settlement and ₹1 lakh per month for five years as part of the divorce agreement.

Priya, relieved to have financial security, was shocked when her chartered accountant told her that the ₹1 lakh monthly payments were taxable! Suddenly, she realized she needed to plan for taxes or risk losing a significant portion of the alimony to the government.

On the other hand, Rohan assumed he could claim tax deductions on the alimony, but he learned the hard way that India’s tax laws don’t allow deductions for alimony payments.

Had they understood the tax implications earlier, they could have structured their agreement better.

Before diving into tax details, let’s clarify the two terms:

Alimony – A financial settlement paid by one spouse to the other after divorce to help the lower-earning spouse maintain their standard of living.

Maintenance – Financial support given during marriage or separation but before a legal divorce is finalized.

While both involve financial transactions between spouses, the tax treatment is significantly different.

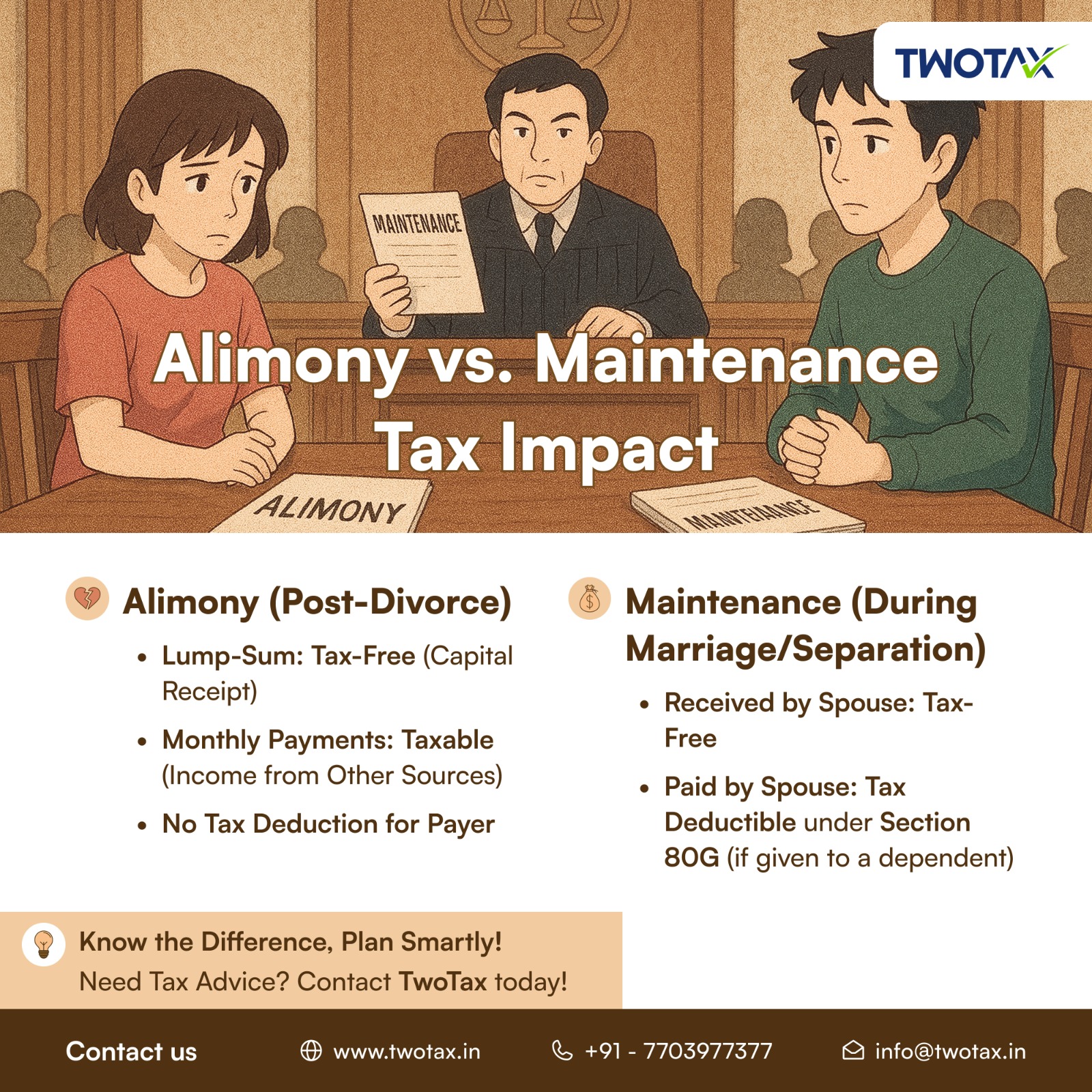

Alimony can be given in two forms – as a lump sum payment or as monthly installments, and their tax implications vary:

1. Lump-Sum Alimony (One-Time Payment)

Tax-Free for the Recipient: If Priya receives ₹50 lakh as a one-time settlement, it is considered a capital receipt and is not taxed under Indian law.

No Deduction for the Payer: Rohan cannot claim a tax deduction for this amount, even though it is a significant financial outflow.

If a court orders a spouse to pay ₹1 crore as alimony in one go, the receiver does not pay any tax on it. However, the payer must arrange funds without any tax relief.

Taxable for the Recipient: Monthly payments are treated as income under Income from Other Sources and taxed based on the recipient's tax slab.

No Deduction for the Payer: The payer still does not get tax relief, making it a costly affair.

If Rohan pays ₹1 lakh per month to Priya for five years, Priya will need to include ₹12 lakh per year in her taxable income. If she falls under the 30% tax slab, she will owe ₹3.6 lakh in taxes annually!

Maintenance is financial support given while the marriage is still legally valid, either during separation or due to financial dependency. The tax treatment of maintenance payments differs:

.png)

Now that we understand how taxation works, here’s how individuals can legally reduce their tax burden:

Since one-time alimony is tax-free, it’s better for the recipient to negotiate a lump-sum payment instead of taxable monthly installments.

Tip: If Priya takes ₹60 lakh as a one-time payment instead of ₹1 lakh per month for five years (₹60 lakh total), she saves nearly ₹10 lakh in taxes!

Instead of paying alimony in cash, consider transferring property or investments to the recipient. Assets like real estate, stocks, or gold are not taxed as immediate income.

Example:

If Rohan transfers a house worth ₹50 lakh to Priya instead of paying alimony in cash, she does not pay tax immediately (though capital gains tax applies if she sells it later).

If maintenance is given for children’s education, medical expenses, or a disabled spouse, it may qualify for tax deductions under Section 80G.

Example:

Instead of paying ₹1 lakh per month directly to Priya, Rohan can allocate ₹50,000 towards child support and claim tax benefits.

Divorce or separation is already emotionally and financially draining. Understanding the tax treatment of alimony and maintenance can help both spouses plan wisely and minimize unnecessary tax liabilities.

Lump-sum alimony is tax-free; monthly alimony is taxable.

Maintenance during marriage is not taxable for the recipient.

The payer cannot claim tax deductions for alimony but may claim Section 80G benefits for dependents.

Smart financial planning, asset transfers, and structured payments can reduce tax burdens.

Tax Partner is India’s most reliable online business service platform, dedicated to helping you in starting, growing, & flourishing your business with our wide array of expert services at a very affordable cost.