Connect with us for all your queries

Under the revised tax regime, the basic exemption limit has been increased from ?3 lakh to ?4 lakh. This means that individuals earning up to ?4 lakh annually will not be required to file income tax returns for the financial year April 1, 2025 – March 31, 2026.

If an individual earns ?3.9 lakh per annum, they are now exempt from filing an income tax return under the new tax regime. However, those opting for the old tax regime must still follow the previous slab structure.

The threshold for Tax Deducted at Source (TDS) on dividend income has been increased from ?5,000 to ?10,000. Now, TDS will be deducted only when dividend earnings exceed ?10,000 per year.

If a shareholder earns ?8,000 as dividend income in a year, no TDS will be deducted. However, if their dividend earnings reach ?12,000, TDS will apply to the excess amount.

For non-senior citizens, the TDS threshold on interest income has been raised from ?40,000 to ?50,000. This benefits individuals earning interest from fixed deposits and savings accounts.

If a depositor earns ?45,000 as interest from a fixed deposit, no TDS will be deducted. However, if the interest income crosses ?50,000, TDS will be applicable.

Central government employees who joined service in 2004 can opt for the Unified Pension Scheme, which offers:

A guaranteed pension of 50% of last drawn pay.

Inflation adjustment.

A minimum monthly payout of ?10,000 after 10 years of service.

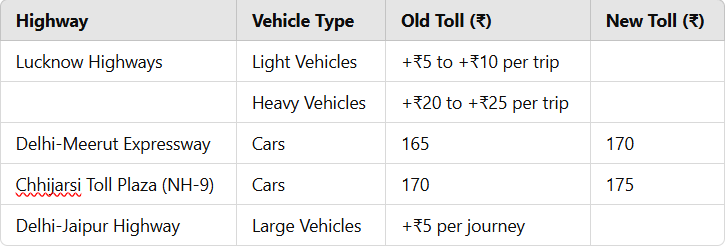

Toll Rate Revisions

Toll rates on National Highways will increase by approximately 3% to account for inflation. Specific increases include:

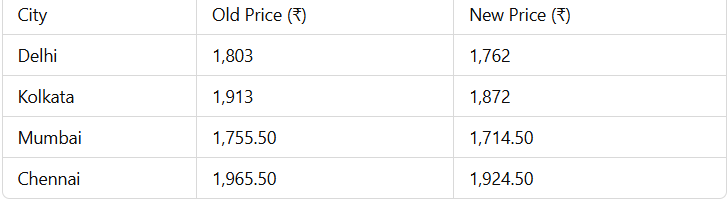

Medicine Price Adjustments

The prices of essential medicines, including painkillers, antibiotics, anti-infectives, anti-diabetic drugs, and cancer medications, will see a moderate increase. The increase aims to offset rising production costs while maintaining affordability for consumers.

The price of natural gas from legacy fields (APM) will rise 4%, increasing from $6.50 per MMBtu to $6.75 per MMBtu.

Oil marketing companies have reduced the price of 19-kg commercial LPG cylinders by ?41.

Banks and UPI apps will now update mobile number records weekly to prevent fraud from recycled numbers.

Users will need to explicitly opt in before UPI apps assign or update their numeric UPI IDs, enhancing security and preventing unauthorized transactions.

Businesses generating e-way bills and e-invoices must now undergo multi-factor authentication (MFA) for additional security and compliance.

A revised Input Service Distributor (ISD) mechanism will be implemented to streamline GST input tax credit distribution among business units.

Banks can now provide home loans up to ?50 lakh in metro cities under priority sector lending norms, facilitating easier access to housing finance.

A borrower in Mumbai seeking a ?48 lakh home loan will now benefit from lower interest rates and relaxed approval criteria under priority sector norms.

The changes taking effect from April 1, 2025, bring significant benefits to taxpayers, commuters, businesses, and consumers. While income tax relief and small loan access enhance financial ease, toll hikes and medicine price increases may impact daily expenses. Businesses must adapt to the new GST compliance mechanisms, and digital transactions will see enhanced security measures under UPI reforms. These developments aim to balance economic growth, consumer protection, and fiscal responsibility in the upcoming financial year.

Tax Partner is India’s most reliable online business service platform, dedicated to helping you in starting, growing, & flourishing your business with our wide array of expert services at a very affordable cost.