Connect with us for all your queries

Section 80E is designed to encourage individuals to invest in higher education by offering a tax deduction on the interest component of educational loans. This provision is particularly beneficial for students and their families who may face substantial financial pressures due to rising education costs.

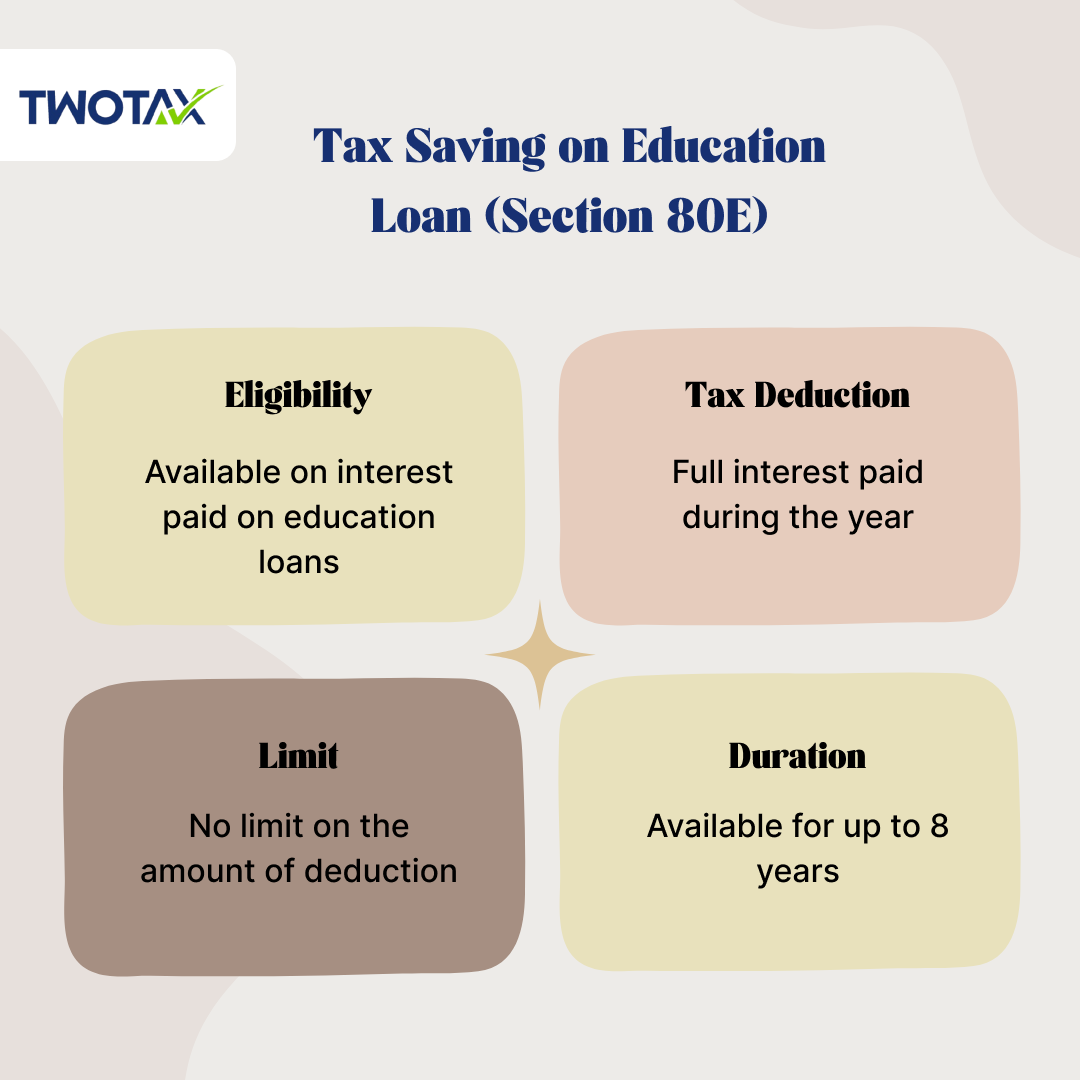

Deduction on Interest Only: The deduction is applicable only to the interest paid on the educational loan. No deductions can be claimed on the principal repayment.

No Maximum Limit: Unlike other sections that have caps on deductions (like Section 80C), there is no upper limit on the amount of interest that can be claimed under Section 80E. This means that taxpayers can deduct the entire interest amount paid during the financial year from their taxable income.

Duration of Deduction: The deduction can be claimed for a maximum period of 8 years, starting from the year in which the taxpayer begins repaying the loan interest or until the entire interest has been repaid, whichever comes first.

To qualify for deductions under Section 80E, individuals must meet specific criteria:

Loan Purpose: The loan must be taken exclusively for pursuing higher education after completing senior secondary education (12th grade). Eligible courses include undergraduate and postgraduate programs in fields such as engineering, medicine, management, etc.

Lending Institutions: The loan must be obtained from recognized financial institutions or charitable organizations. Loans from friends or family do not qualify.

Beneficiaries: The taxpayer can claim deductions for loans taken for their own education, as well as for the education of their spouse, children, or any student over whom they have legal custody.

Repayment Requirement: Deductions can only be claimed once repayment of interest has commenced.

Claiming deductions under Section 80E involves a few straightforward steps:

Obtain Loan Statement: At the end of each financial year, borrowers should request a statement from their lending institution detailing the total interest paid during that year.

File Income Tax Return: When filing income tax returns, taxpayers should include the total interest paid as a deduction under Section 80E in their computation of taxable income.

Documentation: Maintain proper documentation including loan agreements and statements from the lender to substantiate claims if required by tax authorities.

To better understand how Section 80E works, let’s consider a few examples:

Rohan takes an education loan of ₹10 lakhs at an interest rate of 10% per annum to pursue an MBA program.

Yearly Interest Payment Calculation:

The annual interest payment for Rohan would be approximately ₹1 lakh (assuming simple interest for simplicity).

Tax Deduction:

If Rohan starts repaying this loan in April 2023 and pays ₹1 lakh as interest in FY 2023-24, he can claim this entire amount as a deduction under Section 80E when filing his income tax return.

Priya took an education loan of ₹15 lakhs at an interest rate of 12% per annum to study abroad.

Yearly Interest Payment Calculation:

Assuming she pays ₹1.8 lakhs in interest during her first year of repayment (2024-25).

Tax Deduction:

Priya can claim ₹1.8 lakhs as a deduction under Section 80E for FY 2024-25 without any maximum limit on deductions.

If Mr. Sharma takes a loan for his daughter’s engineering degree and pays ₹2 lakhs as interest in one financial year:

He can fully claim ₹2 lakhs as a deduction under Section 80E while filing his income tax return.

Loan Tenure vs. Deduction Period: Even if an education loan has a tenure longer than eight years, taxpayers can only claim deductions for up to eight years starting from when they begin repaying the loan.

Interest Accruals: Only actual payments made during the financial year are eligible for deductions; accrued but unpaid interest cannot be claimed.

Multiple Loans: If a taxpayer has taken multiple educational loans for different courses or family members, they can aggregate all eligible interest payments and claim them under Section 80E.

To make the most out of Section 80E deductions:

Plan Ahead: Consider taking educational loans early if you anticipate needing them in future academic pursuits.

Keep Track of Payments: Maintain meticulous records of all payments made towards your educational loans throughout the financial year.

Consult Tax Professionals: If you have complex financial situations or multiple loans, consulting with a tax advisor can help ensure you maximize your deductions effectively.

Combine with Other Deductions: While claiming deductions under Section 80C (which covers principal repayments and investments), you can also simultaneously claim deductions under Section 80E for interest payments without any overlap issues.

Section 80E serves as an essential tool for individuals pursuing higher education through loans by providing significant tax relief on interest payments. By understanding its provisions and eligibility criteria, taxpayers can effectively reduce their taxable income and ease their financial burden associated with educational expenses. Whether you're funding your own education or that of your dependents, leveraging this section can lead to substantial savings over time.

Tax Partner is India’s most reliable online business service platform, dedicated to helping you in starting, growing, & flourishing your business with our wide array of expert services at a very affordable cost.